Introduction

Traditional and Roth IRAs are powerful tools, but trying to compare affects is a daunting task. Does a current year tax deduction justify having to pay taxes at ordinary income rates? What if the tax saving was invested in a taxable account? What is the benefit over investing in a taxable account? To answer these problems, these investment strategies were simulated by hand with the following assumptions.

- Four strategies: Taxable, Roth IRA, Traditional IRA, and Traditional IRA with reinvestment of tax deduction

- Use 2023 Single Filer status for tax rates and standard deduction (only)

- Consider yearly incomes of 41184, 60840, and 73000 (25%, 50%, and maximum modified gross adjusted income to contribute to a traditional IRA with full deduction)12

- No other investment income sources other than the selected method

- Investment taxes would be paid out of earned income rather than deceasing balance (will keep track of additional taxes)

- Dividends to be held in money market fund

- Max contribution of 6500 every year3

- Average market return of 9.5% with 1.8% dividend rate (Based on SPY ETF)4

- Interest rate of 4.5%5

- Expected retirement expenses equals net take home pay (after FICA) for the corresponding income

- 10 years to retirement

| Table 1: Study Conditions | |||

|---|---|---|---|

| Salary/Income | 41184 | 60840 | 73000 |

| Salary/Income | 41184 | 60840 | 73000 |

| Ordinary Income Tax (2023) | 3060 | 5645 | 8321 |

| FICA Tax (2023) | 3151 | 4654 | 5585 |

| Net Income (2023) | 34973 | 50541 | 59094 |

Results

In summary: update stock price → buy/sell stock → calculate interest→ calculate dividend → update stock price (next year)

| Table 2: Summary of Taxes | |||

|---|---|---|---|

| Strategy | Account val at retirement | Investment taxes before retirement | Investment taxes after retirement |

| Roth | 120572.14 | 0 | 0 |

| Taxable @ 41184 | 120572.14 | 138 | 0 |

| Taxable @ 60840 | 120572.14 | 1556 | 0 |

| Taxable @ 73000 | 120572.14 | 1556 | 0 |

| Traditional @ 41184 | 120572.14 | 0 | 8606 |

| Traditional @ 60840 | 120572.14 | 0 | 9789 |

| Traditional @ 73000 | 120572.14 | 0 | 12083 |

| Traditional+ @ 41184 | 135040.80 | 16 | 8633 |

| Traditional+ @ 60840 | 139251.55 | 21 | 9806 |

| Traditional+ @ 73000 | 147098.02 | 343 | 12559 |

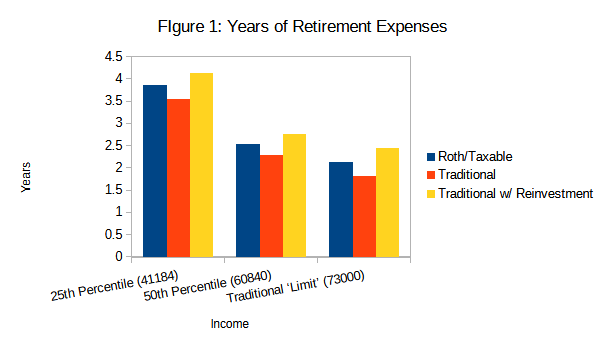

| Table 3: Retirement Expenses (Years) | |||

|---|---|---|---|

| Strategy | 25th Percentile (41184) | 50th Percentile (60840) | Traditional Limit (73000) |

| Roth/Taxable | 3.87 | 2.55 | 2.14 |

| Traditional | 3.54 | 2.30 | 1.82 |

| Traditional w/ Reinvestment | 4.12 | 2.76 | 2.44 |

Discussion

Due to making the same contribution and investments, there is no difference in account values between Roth and Traditional IRA at the start of retirement. Therefore it is more meaningful to examine how many years of retirement expenses can each account support.

Roth IRA at can support at least 3 additional months of expenses when compared to using Traditional alone. The situation is reversed if the tax saving is to be invested in a taxable account. The results above can be further improved by withdrawing from both the Traditional IRA and taxable account at the same time, rather than using up the Traditional before touching the taxable account.

Somewhat surprisingly, investing using taxable account did not incur investment taxes during retirement. There are a few contributing factors:

- Standard deduction allows for the first 13850 made by any source to be tax free (for 2023)6

- Long term capital gains are taxed at 0% up to 446257

- When selling a stock/ETF, the initial contribution is not taxed. If you bought stock for 100 today and sell it for 150 in 366 days, you made 50 in capital gains but have 150 to use as desired

- 10 years is not significant enough time for compounding interest to take affect. After 10 years total contribution is 65000, but the account value is 120572 (gains comprise only 46% of the total account value)

During this study, 100% of the yearly contribution was used to buy stocks/ETF. As the stock market generally provides the greatest returns, this provided the best opportunity to observe differences between the investment accounts. However is generally not appropriate for those nearing retirement as there is risk of having bad investment years.

An additional factor to consider is the amount of money available in case of emergency. The restricted nature of IRA may be a benefit to those who are tempted to spend money rather than save. Traditional IRA will generally incur a 10% early withdrawal penalty in addition to the paying ordinary income tax when younger than 59.5 years old. Assuming the Roth account is more than 5 years old, the contributions are able to be taken out without penalty. Traditional accounts may be liquidated at any time, but with the earnings being subjected to either ordinary or capital gains taxes.

Conclusion

Investing the tax saving in conjunction with a Traditional IRA justifies the additional taxes during retirement when compared to a Roth IRA over a ten year period. Roth IRAs do have the added benefit of less complicated tax filings. Any investing, even in a taxable account, is better than none at all.

References

Note: links viewed in 2024; may change information in future years

- US Bureau of Labor Statistics 2023 – USUAL WEEKLY EARNINGS OF WAGE AND SALARY WORKERS Forth Quartile 2023 – Table 9. Quartiles and selected deciles of usual weekly earnings of full-time wage and salary workers by selected characteristics, 2023 annual averages https://www.bls.gov/news.release/archives/wkyeng_01182024.htm ↩︎

- https://www.irs.gov/retirement-plans/2023-ira-deduction-limits-effect-of-modified-agi-on-deduction-if-you-are-covered-by-a-retirement-plan-at-work ↩︎

- https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits ↩︎

- https://finance.yahoo.com/quote/SPY/ ↩︎

- https://treasurydirect.gov/government/interest-rates-and-prices/certified-interest-rates/annual/fiscal-year-2024/ ↩︎

- https://www.irs.gov/publications/p501 ↩︎

- https://www.irs.gov/taxtopics/tc409 ↩︎